For more than 10 years, RITTERWALD has established itself as the leading Pan-European strategy consultancy and first mover in sustainable housing.

Strategy consultants in residential real estate with private and public sector clients throughout Europe with a presence in Berlin, Frankfurt, Amsterdam, and London.

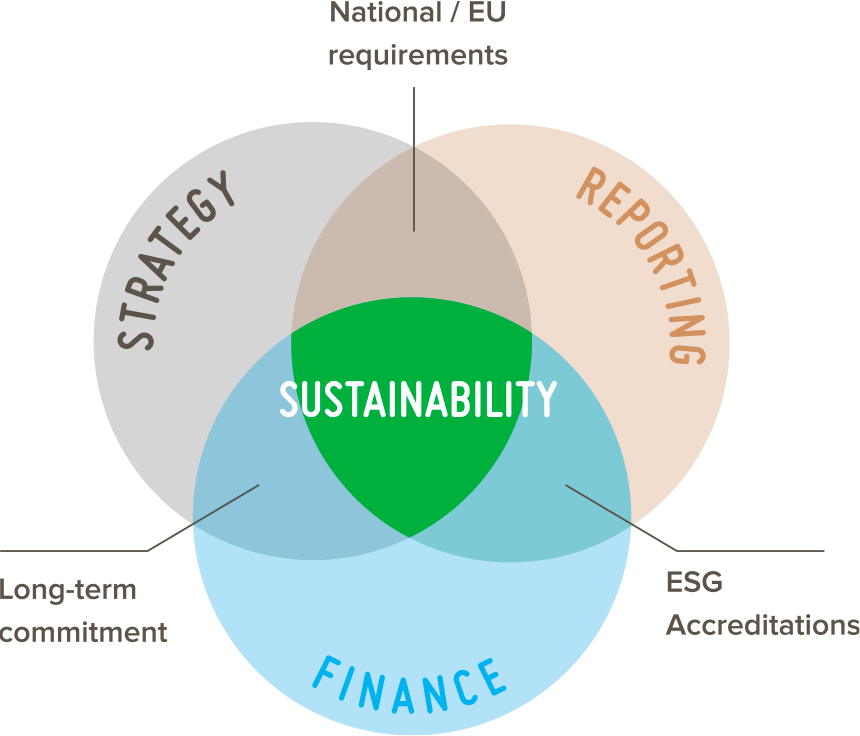

We bring sustainability at the core of business operations by making ESG credentials transparent, consistent, and comparable.

In close cooperation with the social housing and financial sector, we have developed and issued housing accreditation tools and contributed to ESG reporting standards.

We are a proud member of the European Federation for Living, a European network to create more affordable sustainable housing. EFL has over 70 members and associates in 19 countries.

Ever since the 1987 Brundtland report, the notion of Sustainable Development has seen numerous definition changes and amendments. Today, it is fair to agree that the term “sustainability” cannot be dissociated from its three environmental, social and governance pillars. Businesses today, throughout all sectors of the economy take into consideration these three factors. In other words, sustainability has grown to become one, if not the biggest, challenge and opportunity for businesses. But what does this mean for the housing sector?

At RITTERWALD, we understand sustainability to be seen as a holistic approach at the heart of the housing sector. Social and affordable housing providers, by their very essence, serve a social purpose. Today, governments and regulators are encouraging housing providers to go beyond their initial mission. Recent climate and environmental concerns have put pressure on housing providers to drastically reduce their carbon emission and become carbon-neutral by 2050. These harder and more comprising rules are reshuffling the cards as housing providers are seeking new innovative ways to fulfil their objectives. Housing providers are left with the obligation to record new sets of transparent data and demonstrate good governance, which, in return, will open new financing means and gain the interest of new ESG investors.