Affordable housing has many social and environmental aspects. The Certified Sustainable Housing label is the first tool to measure the positive impact of affordable housing companies. It makes the whole sector visible to the capital market and the “low risk asset class” affordable housing accessible to a broad range of investors.

As first mover in sustainable housing, we have developed the Certified Sustainable Housing label, an ESG accreditation that supports housing providers by:

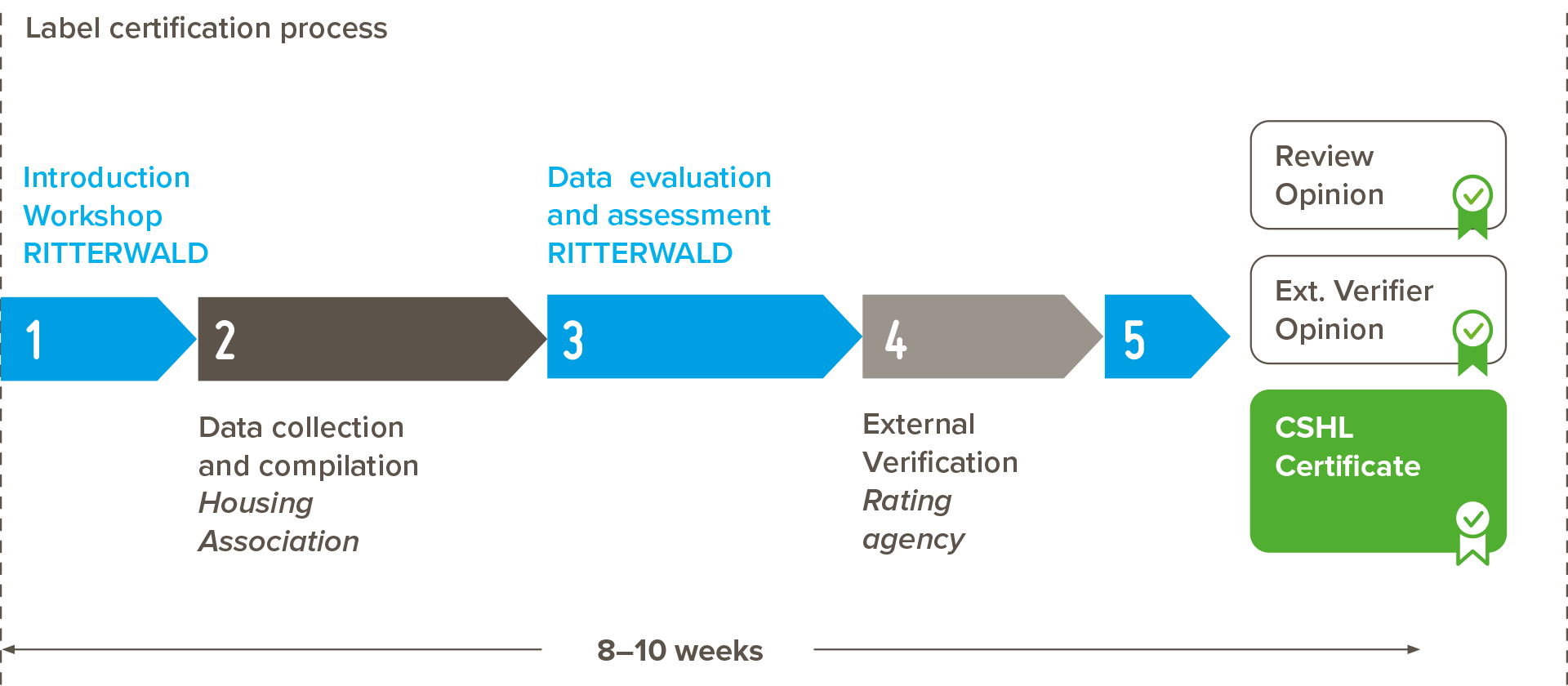

The certification process consists of different distinguished steps that require both the housing provider and RITTERWALD to work together. Our experience teaches us that the overall process takes an estimated 8 to 10 weeks after data provision by the housing provider. Furthermore, an external verifier reviews the evaluation undergone by RITTERWALD to ensure an objective and transparent process.

The Certified Sustainable Housing Label is developed to attract ESG investors in the debt capital markets. RITTERWALD evaluates a housing provider against a comprehensive catalogue of more than 50 individual core and enhanced environmental, social and governance criteria. An external verifier then reviews our findings. If successful in achieving the threshold, the housing provider may then use the Label to present itself as a certified sustainable organisation. An annual review is undertaken to ensure the housing provider has complied with the implementation and fulfilment of the goals set out at the time the Label was awarded.

Convene | esg is the ESG data platform from Convene, the largest Board Portal provider for housing associations in the UK. RITTERWALD is working with the data platform to collect and review the data sets for the Certified Sustainable Housing Label. It is user friendly and saves time and thus cost.

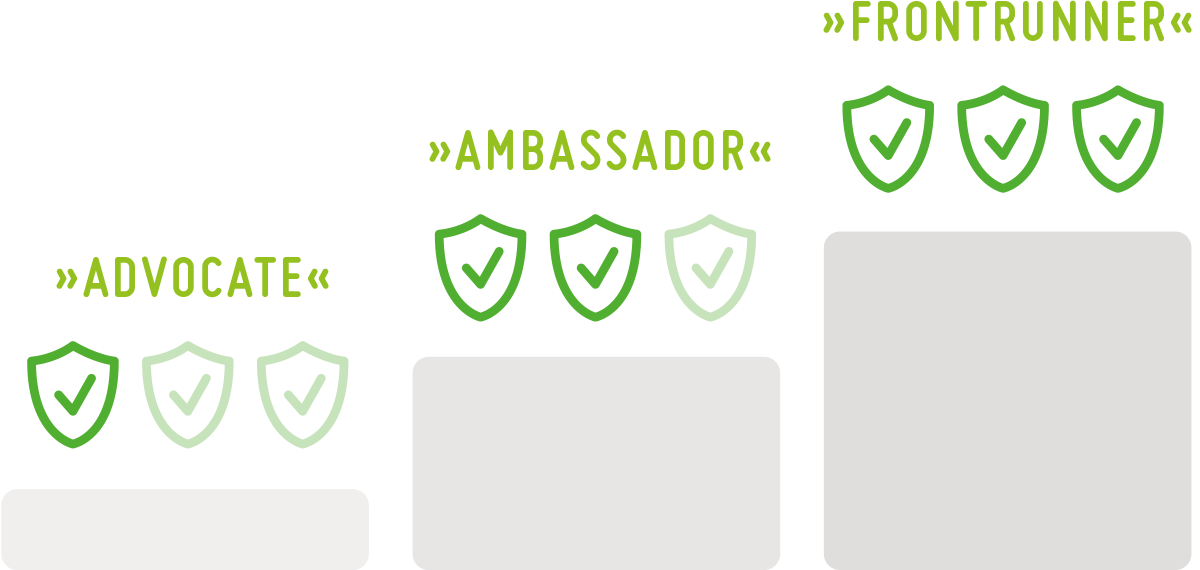

To meet the threshold, a housing provider must exceed 50% of the aggregate score and 35% of the individual scores in all three Environmental, Social and Governance (ESG) dimensions. The housing provider is then ranked in each ESG dimension from ‘Advocate’ to ‘Ambassador’, and finally to ‘Frontrunner’, the highest Label recognition.

As part of the labelling process, we examine housing providers seeking ESG accreditation against a comprehensive ESG criteria catalogue including relevant environmental, social, and governance performance indicators. To ensure strict objectivity and transparency, an External Verifier then reviews our findings.

For the external review of its ESG criteria catalogue, RITTERWALD works with imug | rating.

Should the housing provider pass the evaluation from both RITTERWALD and the External Verifier, the organisation will receive:

Review Opinion from the External Verifier, stating that the RITTERWALD evaluation is thorough and objective

Review Opinion from RITTERWALD, stating that the housing provider met the threshold to pass the evaluation and is awarded a ‘Frontrunner’, ‘Ambassador’, or ‘Advocate’ status depending on the scoring result

The Certified Sustainable Housing Label represents the housing association's successful evaluation